In one of my first notes on here I talked about the benefits of being both systematic and discretionary. I’ve always felt like being one without the other was putting yourself at a disadvantage.

If you’re nothing but discretionary, I just don’t see someone being able to identify the correct inputs for macro and then calculate the outputs correctly in order to accurately assess the macro regime to formulate an edge. Someone that does a really good job of it that you should check out is Prometheus Research.

If someone is nothing but systematic then I don’t think they will be able to correctly recognize underlying shifts in a business that will lead a business to higher prosperity or to a decrease in business performance.

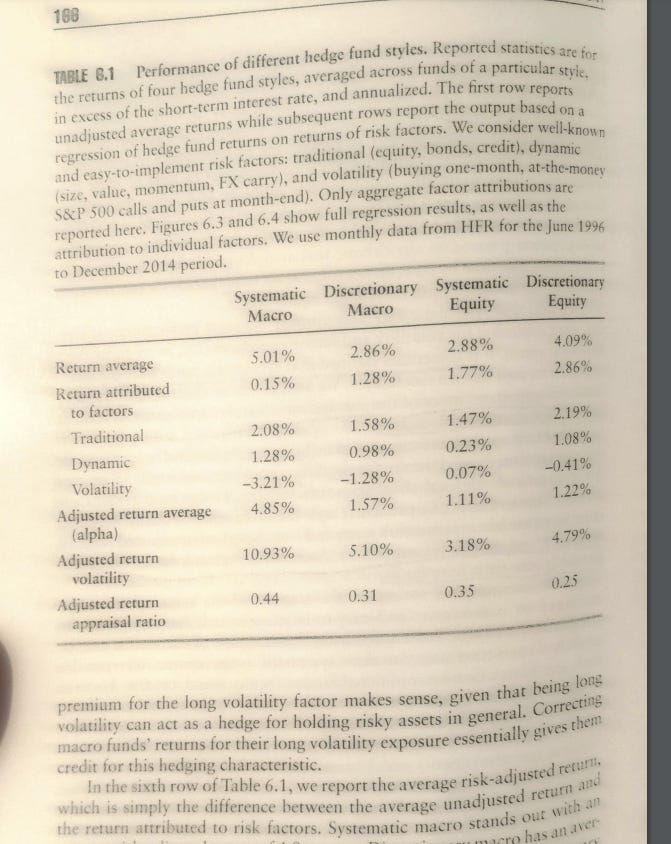

The book Strategic Risk Management: Designing Portfolios and Managing Risk by Campbell Harvey studies the performances of discretionary and systematic hedge funds. These studies find that for Macro, systematic hedge funds outperformed discretionary by a significant amount while discretionary equity funds outperformed systematic.

The conclusion of these studies is to be systematically discretionary. I like to take a top down approach, identify the macro regimes using systematic means to determine asset allocations and then become discretionary in my individual security selections.

Why do I think people need to really utilize systematic systems? Simply because the answer isn’t just hard work anymore.

Look at the state of the United States! We get so many stats shoved in our face; crime is down, GDP per capita is up, market is at record highs but who feels GOOD about that? If you’re rich this doesn’t apply but for the rest of the population, people are feeling the squeeze as they slowly get commoditized and own nothing. Housing affordability is non-existent so you’re a permanent renter. Everything is a subscription with the prices consistently rising, so you’re just a cow getting constantly milked.

What makes this all worse is if something goes wrong, getting a hold of service is harder than ever. It’s either an outsourced AI solution that fails to help or some third-world agent who knows even less than the AI.

So what’s the solution? The answer is to beat this new rat race, the same answer that it has always been. We need leverage to generate wealth and that comes in different forms. Leverage isn’t bad, it’s just simply the use of resources to multiply output. This can be done through capital, labour or technology. I’ll utilize capital leverage at times, labour is out of the question but technology is becoming more and more accessible. The goal of 2025 is to continue to utilize more and more technology, implementing it into systems that can help frame my view.

In 2025 I will be publishing articles on how to develop models to become systematic and even release some models that you the reader can utilize. I’ll also be releasing individual stock ideas and research to use in conjunction with our thematic primers. More effort than ever will be put into this substack in order to provide the upmost value for subscribers. I hope you’re as excited as me to embark on this journey.

Happy New Year and Good Luck in 2025!