I’ve been a big believer in the AI theme since it started as I see real long term potential in it’s capabilities across a wide variety of industries and applications. Currently what the market (perhaps just the naysayers?) sees is just simple LLMs that help decide what to make for dinner or help them answer some programming or basic questions to get their kids through school but I think people really need to look deeper. Let’s keep it simple right now and just look at these LLMs and see how the different models have been trending.

A trend in evaluating models is to include extremely difficult expert-level questions. Two prominent examples are Graduate-Level Google-Proof Q&A Benchmark (GPQA) and Frontier Math. GPQA is made up of 448 multiple choice questions across chemistry, biology and physics. OpenAi found that expert-level humans scored roughly 70% on GPQA Diamond, with o1 scoring 78% on the same set. Last year GPT-4 with search scored 39%. That’s a significant increase in performance in just a year, so are we really seeing a slowdown in AI innovation or are we at the start of another wave of it?

We’ve just seen Google come out with some really exciting products that sort of touches on where I think the next wave in AI is going to be. Let’s start with the release of their Willow Chip, which is a significant breakthrough in quantum computing. This chip achieved below threshold quantum calculations. This milestone is crucial for building quantum computers that are accurate and scalable. It demonstrates improved error correction techniques, allowing the quantum computer to perform calculations with increasing accuracy as they are scaled up (very beneficial to AI). This makes quantum computers more accurate and powerful than current super computers. If this becomes a more accessible technology then we could see more scientific discoveries and solve problems that are currently impossible with classical supercomputers.

Not to pour coldwater on this but consider Quantum error correction (QEC) and it’s overhead which was brought to my attention by QF Research. Signaling has a bit error rate (BER) or a chance that 1 is seen as 0 or vice versa.

Assume BER 10^-12

Send one byte 11010101. The probability of an error in the byte is approx. 8x10^-12. If unacceptable, add 1 parity bit.

11010101 = 213 (odd). If 9th bit = 0 or byte is an even # there has to be an error. Then disregard that byte. The probability that one parity bit reduced probability of an error is 14 orders of that magnitude at a cost of 9 bits to transmit a byte.

The reality is more complicated but this is the principle behind EC. Real systems take into account DC balance, clock recovery etc and what google made references to in their release is classic EC. The complexity and overhead of QEC are significant challenges and aren’t really any closer to being solved. Still, this is a step in the right direction. By the way, if the above sounds complicated or you don’t understand, just plug it into perplexity and get it to dumb down whatever you read, it’s what I did.

Not only did Google come out with the Willow Chip but they also released it’s Gemini 2.0 AI Model which is designed for the “agentic era” which could be the beginning of the next wave of innovation that I alluded to earlier. This is where AI systems can understand the world, think multiple steps ahead and take action on behalf of users with their supervision. With Gemini 2.0 comes the introduction of native image and audio generation, enabling it to produce synthetic audio and images which will pave the way for more advanced AI agents. Furthermore, it introduces a new feature called Deep Research which uses advanced reasoning and long context capabilities to act as a research assistant. It will be integrated into various Google products such as google search which you can see in action here. I truly believe this is just the beginning of the agency trend. We have Google’s Deep Mind already announcing VEO 2 which is their state of the art video generation model which produces realistic, high quality clips from text or image prompts. It’s able to create videos at resolutions up to 4k, understand camera controls in prompts such as wide shot, pov and drone shots as well as recreate real-world physics and realistic human expressions. AI is already a useful tool for myself as I can basically recreate an analyst with a little work and a whole lot less money but I think we are getting closer and closer to that actually being the case.

So we see models that are constantly improving but I actually think that there is more going on behind closed doors. Let’s look at the case of Anthropic’s Claude 3.5 Opus and how they didn’t release it. This is because Anthropic used Claude 3.5 Opus to generate synthetic data and for reward modeling to improve Claude 3.5 Sonnet significantly, alongside user data. Inference costs didn’t change drastically but the models performance did. So sometimes we might see stuff not get released because on a cost basis it does not make economic sense to do so relative to releasing an improved model trained on synthetic data produced from the unreleased models. This means that during times where it does not appear as though there isn’t a lot of advancements happening, it might just be smart to be patient and wait because this could be happening in the background.

This perspective especially makes sense to me when we have earnings of various companies in the background consistently reporting strong results throughout periods of a so called lack of advancement that gets people concerned. Throughout this year there has not been a dip of earnings or expectations across the industry but to really gain this perspective would require expanding on companies beyond just NVDA. We recently saw very strong results from AVGO 0.00%↑.

Rev $14.1B v $14.1B cons

$1.42 v $1.39 EPS

64.6% EBITDA vs 64% guide

Semi $8.23B v $8.05B

Jan Q guide was $14.6B in-line with cons but EBITDA was 66% v 64%

What was really interesting was some of the details confirmed through the call. $60-90B SAM from 3 current customers for F2027. That’s one year and not cumulative as what was implied over the summer. F2024 SAM was $17.5B v AI rev of $12.2B. The implied AI revenue for F2027 is $50B and doesn’t include 2 other customers.

Let’s also not forget that AI networking was +158% Y/Y compared to NVDA 0.00%↑ +20% Y/Y. So AI networking wasn’t weak as an industry but it seems that NVDA just actually has competition. This isn’t a bad thing (good thing if you’ve branched out beyond NVDA) but it’s just something to be mindful of when people who are bearish on AI and use NVDA as their example.

We need to consistently look at the whole ecosystem to get a guage of the AI theme as a whole. Trainium 2 and ASICs in general could be bearish for NVDA and there is so many other ways to have exposure to the AI theme than just NVDA. Some of the stuff we’ve written about previously have done very well since which you can read about below.

AI Revolution in 2024: Market Impact and Investment Opportunities

Usually thematic updates come after publishing an original thesis but in this case this update comes with no former thesis. I have written a little about AI being a large macro trend and unless you live under a rock you didn’t need me to tell you this. This is largely why I never published an original thesis as there was already plenty of pieces out the…

I’m happy to report this basket is up 42.24% since it was published. This is remarkable performance and this melt up has many (including myself) asking, is this a bubble? So let’s look at that a little closer and also utilize the George Soros framework for a bubble. If you remember, I talked about this in one of my first articles and you can see the summary below.

The first stage is the emergence of a trend. Trends often emerge from significant events or are highlighted by major beneficiaries (think CHATGPT for AI).

The main beneficiaries may trend higher for a period before a major fundamental event makes the market take notice of this trend. This is usually for very specific names in the trend and it’s usually also a good idea to short the laggards before the trend really emerges for the masses.

This stage is the pinnacle of thematic investing. It’s when the trend is at mass exuberance and latecomers start promoting stocks that barely relate to the trend. This is the time to really be selective of both longs and shorts, eventually selling into the peak hype. This stage can last a quarter or two or a few years, timing this is crucial.

This is the peak. This is when the market is flooded with companies barely related to the trend at best and will likely never turn a profit. The market’s expectations have entered the realm of fantastical and have almost no basis in reality. This is also when everyone is forced to play the trend, and the way they do are through all terrible companies. It’s the riskiest phase and the time to reduce the long positioning and realize profits on short positions if they’re profitable. Then identify new shorts based on false promises of beta to the theme that have no fundamental justification. This is dangerous to do if you can’t identify the stage of the cycle. Monitor these shorts as reflexivity (Alchemy of Finance topic) will be at it’s peak and consecutive red weeks can work as a signal. Relative strength is also a hugely important signal.

I can see how someone may argue that we are at stage 3 or 4 although I haven’t seen much promoting of stocks that barely relate to the trend. We could potentially see that if this theme of quantum computing starts to take hold when really I just don’t think we are that close to utilizing it. I’m starting to see AI agent plays starting to really moon when I don’t think that they actually are truly good beneficaries of AI. Take ASAN 0.00%↑ for example, it’s up close to 150% since October but still many other stocks that could be marketed as AI agent plays such as PATH 0.00%↑that haven’t really done anything.

Where I really think people start to believe that this is a bubble is due to general market frothiness and they automatically assume AI must be a bubble as it’s been a dominant theme for more than a year now. I mean Bitcoin is ripping, up almost 85% since late October and don’t look now but ARKK is breaking out of a year long base and up 40% since the election. We also have memecoins such as fartcoin up 485% in the last two weeks and over $800M in marketcap. I mean fartcoin, really? What is that?

But let’s look at some AI names and specifically what I’ve mentioned here on this substack and some valuation metrics to get a better view of if AI is in a bubble. We’ll start with the highly talked about MAG 7 names (excluding TSLA). Let’s look at P/E NTM and earnings growth for AAPL 0.00%↑ META 0.00%↑ GOOGL 0.00%↑ AMZN 0.00%↑ MSFT 0.00%↑ and NVDA 0.00%↑

Some of the stocks when looking at earnings growth probably lean on the more expensive side but bubble? I don’t think so. The iron clad balance sheets along with the free cash flow generation produced from each company deserve higher valuations on a qualitative basis. What about other stocks that I’ve talked about or are popular in the space such as AMD 0.00%↑ MRVL 0.00%↑ CIEN 0.00%↑ AVGO 0.00%↑ COHR 0.00%↑ DELL 0.00%↑

These are a little more expensive but these stocks are also growing their earnings at a higher rate on a YoY % basis. Also as we noted above the potential for AVGO 0.00%↑ is really high. This also applies to MRVL 0.00%↑ which I’m very bullish on but is now trading much higher post earnings. But all of the above doesn’t scream bubble to me. I just don’t see the 1999/2000 comparison at all with these stocks when each earnings report consistently tells us more is coming. It tells me that the market is a bit expensive but shouldn’t the high quality stocks in the stock market with the world’s strongest economy trade at a premium? After all look at the rest of the world, where else are you going to put money to work? Europe, China, Canada economies all on the weaker side and not improving.

Another indication of a bubble is really crowded positioning but I don’t really see indications of that either. I subscribe to Your Weekend Reading who are nice enough to analyze the top 20 equity positions at 338 hedge funds.

Mag 7 stocks are at the top which makes sense given current passive market dynamics. But other than those stocks the only other AI stock on there is AVGO which is interesting to note but after the recent earnings makes sense given the really optimistic outlook for the stock. So, AI names aren’t in every single hedge funds portfolio which makes me optimistic that positioning isn’t too crowded. We also have survey data out of GS indicating that not only positioning isn’t crowded, but it’s actually underweight.

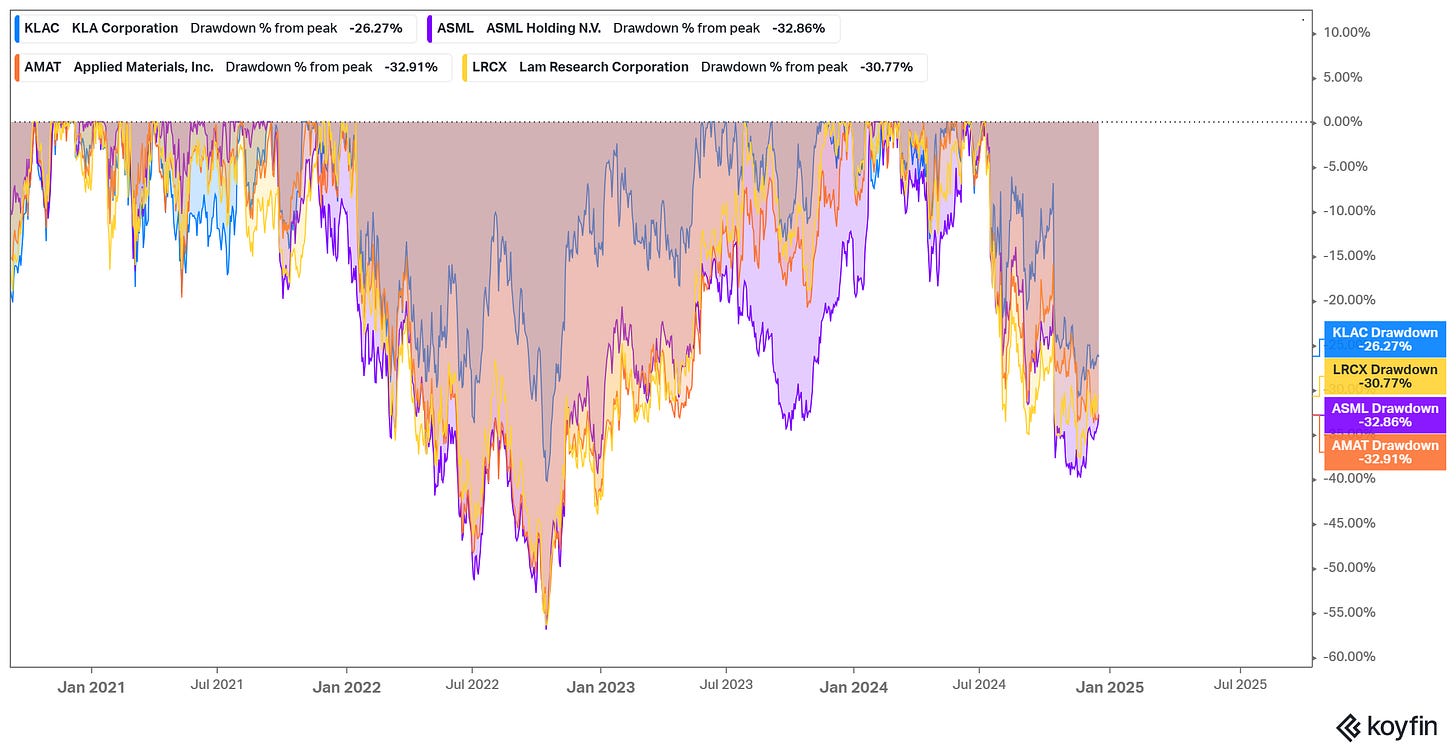

It’s important to note that relative is different to absolute net. Total equity nets rose some but not at highs. Now I’m not saying all of this to say we are still early innings in AI but what I am saying is that I don’t think we are at a peak. I think that this theme will last years and we will consistently rotate within the AI theme to benefit from new technology and trends. For instance, let’s look at semi-cap which has gone through a pretty decent correction while interconnects have been trending up.

This rotation isn’t the only thing that could cause AI stocks to go down but also general sentiment. Ultimately I don’t think AI is some sort of frothing bubble but the general market is pretty frothy right now and while positioning in AI stocks seems to be relatively light, a market correction would definitely have an adverse effect. This is obviously an ongoing situation that we need to monitor and Q1 seems like a likely time for a needed correction to happen. I’ll talk about this more in another note or through twitter threads. For now I hope you enjoyed reading this note and consider subscribing to see more like it. I’ll have an individual AI stock name to talk about soon!