Another year has gone by and as I write this I overcome a wave of emotions. 2023 was a tough grueling year filled with volatility and uncertainty. It was confusing and challenging which for any trader means it was a great year. It was a great year to learn, a great year to practice humility and it was a year filled with at times bitterness that made the wins even more sweet. I cannot wait to apply the things I learned in 2023 to my trading in 2024 and keep progressing to being the best trader I can be.

The beginning of the year is a great time to reflect on the previous year but it’s also a great time to prepare for the year to come. If you’ve noticed what I have noticed many people seem to believe this involves a lot of forecasting and predicting. Maybe it’s predicting the strength of different economies, where the S&P500 or the 10-Year will trade. My question is why? What is the purpose of this forecasting? It’s of course useful to have an idea of what the strength of the economy is and where it is headed, but new information can come and change everything. Take for instance this time last year, everyone was certain we were going to enter a recession. If you shared this view and piled into TLT you had a return of 3.3% after suffering through a massive drawdown and missing out on huge returns comparatively when looking at equities. Watch this video:

This video was first brought to my attention by Capital Flows. I think he’s a great follow and his insights are very valuable and I’m glad he shared this video. This video highlights what I’m talking about. Making predictions is a futile exercise, a far better use of your time is to plan for a variety of different outcomes and scenarios. So what I really want to do at the end of the year is maybe think about some trades that might work out in the next year. Some of these trades I might want to put on immediately, I might put on later if certain circumstances permit or they may never happen. The point is to be ready.

Trade Idea 1: Long China

If you haven’t done so I recommend reading my substack on China which you can read here.

China Isn't Dead

If you’ve been paying attention over the past year then you would have seen the many headlines and news articles detailing China’s imminent demise and the market has been very reactive to this as we’ve seen Chinese stocks get absolutely crushed. There’s many reasons w…

I was mulling over somethings over a couple of bottles of wine over the holidays when I had a thought. I remembered that the market came in to 2023 massively underweight equities due to the fear as a result of the beatings took during 2022. We all know what happened next. This year I think the same thing is happening but in Chinese equities. I have the basket as outlined in the article but I sold Wynn and bought Baidu instead. I also added some FXI calls with March and May expirations. These calls might work or they might not but the risk/reward makes it worth the bet.

Trade Idea 2: Long Iron Ore

Iron ore has been making new highs, I outlined my thoughts in these tweets here. I still really believe in this trade and think VALE and LIF will trade higher by end of Q1 and have added to both the names since my original tweets.

Trade Idea 3: Long GEO

If you’ve been paying attention to the news, it’s likely you would have noticed the record number of illegal immigrants and refugees crossing into the U.S. This presents GEO with an enormous opportunity.

GEO is a government service provider specializing in design, financing, development and support services for secure facilities, processing centers and community reentry centers in the us, australia, south africa and the uk. Services include enhanced in-custody rehab and post release support through the electronic monitoring, secure transportation and correctional health and mental health care.

They operate the smart link app for ICE. It's a mobile app used to monitor immigrants during conditional release with 150k+ people monitored through the app with many others on ankle monitors (also a geo business). There is a massive backlog meaning that thousands of immigrants could be monitored on the app for years. There is currently 2million and growing backlog.

I love easy to understand napkin math, I want to always keep things as dumb as I can. Let’s say enrollment over the next 18 months is 500k people, if GEO gets $8 per person at 50% EBITDA margin then there is potential of $938MM in EBITDA. At a 6X multiple that implies a $30 share price.

Trade Idea 3: Long Potential Buyout Candidates

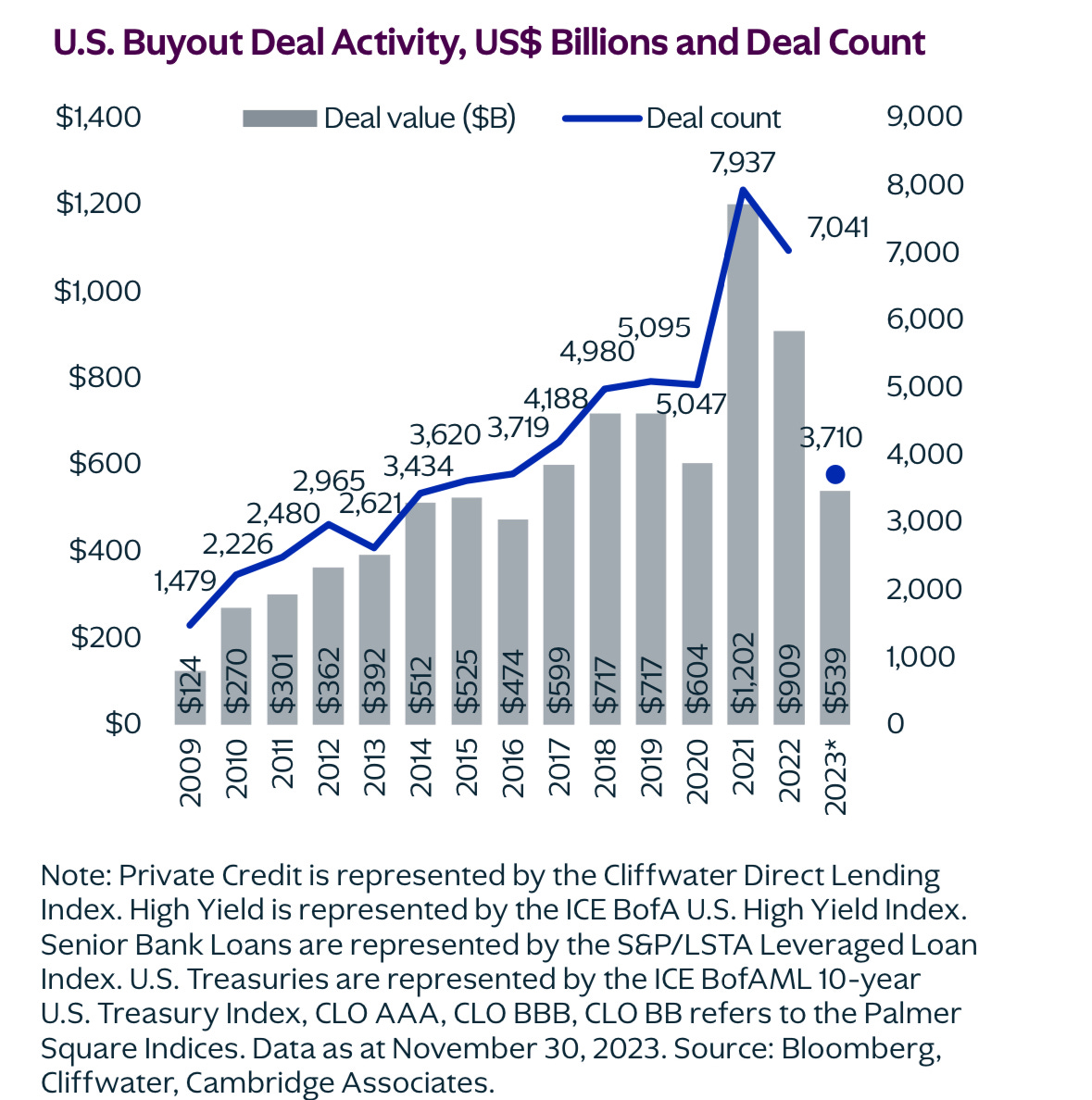

Deals have significantly declined in the past 2 years while money has continuously flowed into private equity without interruption. If we remove large cap stocks, then market valuations are actually below their averages with small caps specifically being close to the cheapest they’ve been in the past two decades.

I expect an increase in the amount of public to private deals, specifically in healthcare and tech. This has been backed by some of the institutions. Now typically, I don’t really buy what the institutions try to sell to us through the media, but when the people who are speaking are the ones making the decisions and there is a unifying sentiment as we have seen, I do think it’s prudent to listen.

Trade Idea 4: Long Unity

This idea builds on Trade Idea 3.

The company makes unity game engine which is the most popular game engines for 3d games by number of games made on it. Most of these games are low quality mobile games. It’s pure subscription software for core engines that cant fully monetize it's growing end-market

In Unity’s 2020 S-1 before its IPO, it estimated its Total Addressable Market at $29 billion (including both its core engine and monetization products) vs. the nearly $190 billion video game market in 2023 per Newzoo data and the estimated Metaverse TAM of $8-13 trillion, based on estimates from Citi, Goldman Sachs, Morgan Stanley and KPMG. So the potential TAM is huge but it's safe to say Unity can't fully scale to capture any sort of significant share of these end markets.

Unity realized this themselves and responded by building out a suite of game operation and monetization products, enabling developers to more easily bring new titles to life. They acquired Ironsource to double down on its advertising monetization strategy. This was a short term fix to get closer to ebitda and cash flow profitability. Apple then pushed harder for their privacy centric network and removal of idfa, which had a big impact across different industries but really affected Unity. They had to think of a new way to better monetize their products. So Unity implemented new pricing scheme, charging customers per install and other fees to more closely scale unity's revenue with that of its customers. This made sense from an objective and fundamental analysis but the community hated it. Unity received major backlash and it led to the effective firing of the CEO.

Why takeover makes sense

Appointed Jim Whitehurst, former CEO of red hat as an interim CEO. Respected executive in enterprise software for turning around red hat, selling it to ibm and his tenure at ibm. He has zero gaming experience. His first efforts have been to massively cut costs including killing off product segments that are non-core to unity engine. Good example is shutting down of Weta Digital, the vfx company unity acquired from peter jackson for $1.6Bn. I’m expecting him to keep cutting costs and culling non-core products to make business leaner and easier to sell.

Whitehurst was granted 200k rsus with a 50/50 vesting schedule for feb 2024 and may 2024, valued at about $6.5mn. Clearly not there for long term and given his background and the fundamental challenges facing unity that aren't addressed by these cost cuts, it makes sense that he seeks to sell Unity.

Suitors

Most megacap tech companies especially those with gaming ambitions like amazon, microsoft and netflix while other game publishers could also be interested. Apple could also make sense but they have never been a large serial acquirer.

Msft makes the most sense. Can offer unity engine out of the azure cloud to drive more azure usgae while also leveraging unity's engine and admon capabilities to build out its mobile gaming aspirations. Mobile gaming and game store was one of the key reasons it bought atvi. Msft could laso bring financial and technical riigor to improve Unity's core product suite and make it more competitive with epic and others while also making it more profitable.

Valuation

Anchoring of unity investors to post covid market highs for the stock make striking a deal at a reasonable price tough, but strategically this would make a lot of sense for msft.

Currently trades at 6.9x price to sales, 25.4x 2024 ebitda. If no deal materializes its not unreasonable to trade down to 5x revenue or lower but that’s not a ton of downside. In a takeout I think it can fetch 10x revenue which implies price of about $60 in a takeout and puts it at 30-40x ebitda.

It could also rally to higher valuations standalone if the turnaround story takes hold, with an overall bullish sentiment for speculative tech continues to take hold in markets.

Trade Idea 5: Short VLO and MPC

There has been an increase in biofuel demand speculation that some companies have positioned themselves for. It’s my belief that the speculated demand is too bullish and companies have overbuilt capacity which will lead to disappointing results in 2024. I also think refinery capacity has increased meaningfully leading to refiners appearing to be a fundamentally sound short by themselves.

Trade Idea 6: Long MGDL

Company’s resmetirom is expected to be the first approved therapy for NASH in March 2024

NASH Market is expected to be a $20 Billion market by 2030

NASH is a severe inflammatory version of nonalcoholic fatty liver disease

Believed to burden 25% of NAFLD patients. 25% of Americans are affected by NAFLD.

Company dipped in 2023 as GLP-1 analogs prescribed for weight loss and type 2 diabetes have been clearing NASH as a side effect. Obesity and diabetes are two of the largest contributors to NASH.

While this could potentially negatively affect the company, I believe the first mover advantage will be very real and the company will benefit immensely from being first approved in March.

Julian Baker of the biotech investment house Baker Bros. is Madrigal's Chairman of the Board. His firm added 116,166 shares since mid-November, bringing its total ownership interest to roughly 10%. The last time a Baker Bros. assumed chairmanship of a biotech, it resulted in Pfizer's $43 billion acquisition of Seagen.

Trade Idea 7: Long FNMA

This has been a speculative trade that has basically gone on for the last 13 years, attracting investors such as Bill Ackman among others. The summary of the idea is as follows:

Been under government conservatorship since GFC

Has generated significant profits since then despite this. Trades well below book value.

Potential privatization of these entities could realize substantial gains for the government

Trump could get reelected, his previous term showed intent to privatize the entity and his reelection would likely reignite these efforts

Government has recovered it’s investment many times over so there is now a fiscal incentive to privatize as sitting on it can be seen as poor capital allocation. Something that is very important and will likely be an important election topic given the recent deficits.

It’s essentially a very cheap option that could 5x, but it comes with risks such as political uncertainty, interest rate dynamics and regulatory hurdles.

Trade Idea 8: Long MRVL

Unless you were living under a rock this past year than you would have heard about AI as one of the main themes. I don’t think this theme is going anywhere but I think focuses can shift over time as the theme plays out. I think we will likely see an increased focus on the infrastructure necessary to train AI. This will increase the demand for optics, interconnectors, networking and memory. Some of this, Marvell offers and excels at. They are top class in optical components which should position them well for the continued structural demand for networking components.

The big problem with large models is they struggle to fit on a GPU, so going forward there will be a need to string many GPUs in parallel.

As we scale thousands of GPUs into clusters, Marvell will benefit from volume as each transceiver they sell has to be attached to a GPU. The 128h100 cluster (1024 GPUs) has 1536 800g transceivers and 935 400g transceivers. Another 500 in storage transceivers. Attach rate is about two transceivers per gpu.

Cost of DGC H100 is $500k per sever rack which means that the vast majority of the system is $64M spent on DGX H100s but adding all optical transceivers is another $3.5M, over half of which will go to Marvell.

I also think Marvell is likely now done with acquisitions which will lower the amount of SBC. Once this is lowered, Marvell’s earnings quality will improve and I think the stock will get rerated higher as a result.

Trade Idea 9: Short USDJPY

The yen has been advacing from a significantly weak position which has been influenced by Japanese hedge adjustments and carry trades. When yields have fallen in the past, the yen has usually responded favorably. It’s possible we continue to see falling yields well into 2024.

I’m optimistic about Asian growth which will indirectly benefit the yen.

BOJ stance seems to be shifting and there could be a potential change to the YCC currently being used.

Improving relations with China could indirectly benefit the yen.

Technically the chart looks pretty good and looks like it’s at the start of a downtrend

Trade Idea 10: Long EMLC

If the fed goes on an easing cycle it’s likely that other countries will follow acting as a tailwind for EM debt.

Thank you for reading! If you want to discuss further you can find me on twitter here. Alternatively, I’m a part of a discord that is completely free. It’s just a collection of traders from all different backgrounds that talk about the markets, so come check it out here! If you haven’t done so, please like and subscribe, it really helps with growth! Last of all, please remember that you should not consider this as investment advice, I am an Unheard of Capitalist, why would you blindly follow someone that’s unknown?

Happy Trading in 2024!